Key points of the annual report:

- decision on pension increase: 2.84%;

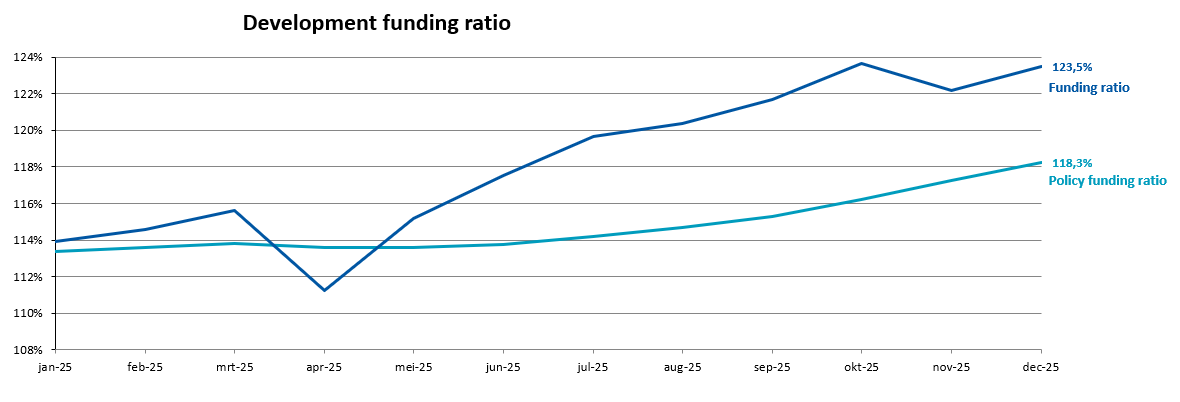

- current coverage ratio at year-end 2025: 123.5% (year-end 2024 111.7%);

- investment result 2025: -1.6%;

- investment result Q4 2025: +0.2%;

- available capital as at year-end 2025: € 533 billion;

- liabilities as at year-end 2025 € 432 billion (year-end 2024 € 486 billion).

In 2025, ABP’s coverage ratio rose significantly to 123.5% at the end of the year, the main reason being the increased interest rates. On the other hand, it was not a good investment year, due to the turmoil in the financial markets caused by trade tariffs and wars in Europe and beyond. The return was negative in the first quart of 2025, but it recovered in the following quarters. The investment result for the whole of 2025 was -1.6%, mainly due to rising interest rates and a falling US dollar. Liabilities also fell due to higher interest rates. By the end of 2025, ABP was therefore still better off than at the beginning of the year, and as a result, we were able to increase pensions by 2.84%.

Harmen van Wijnen, Chair of the Board of Trustees: “For ABP, it was a year with two sides of the same coin: the investments achieved a negative result for the whole of 2025, mainly due to increased interest rates and the falling US dollar. On the other hand, the increased interest rates were what increased the coverage ratio every quarter, up to 123.5% at the end of 2025. It was a turbulent year in the financial markets. As a long-term investor, ABP keeps its cool in turbulent times, and the fund invests globally in different types of investments with a diversified portfolio, to ensure the most stable pension possible with the greatest purchasing power for our participants. ABP was able to increase pensions by 2.84% this year because, despite everything, we are in a better position. If this continues, it will be beneficial because a healthy financial position means a good starting point for the transition to the new pension rules on 1 January 2027. We are on track.”